Purchasing a home can be a daunting task, especially for first time homebuyers. The first step to purchasing a home is to get pre-approved for a Home Loan. This way you’ll have a clear understanding of affordability/costs and you can get access to viewing properties as many Seller require a pre-approval to schedule a showing appointment. This letter is issued after the lender has evaluated your financial history, income, as well as your assets.

Here are the things you need for pre approval:

1. Tax Returns

Lenders want a clear idea of your financial situation. You may be required to sign a Form 4506-T, which allows the lender to request a copy of your tax returns from the IRS. Lenders typically want to see two years’ of tax returns. This is to ensure that your annual income is consistent with your reported income.

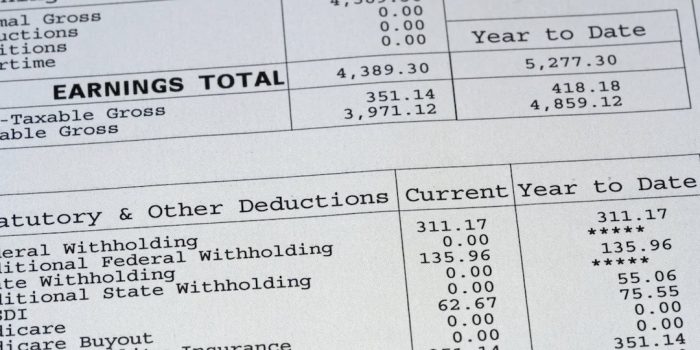

2. Pay stubs, W-2s or other proof of income

Lenders will ask for pay stubs for the last two months. Your tax return will help give a more accurate picture of your overall financial well-being, while paystubs help them peek at your current earnings.

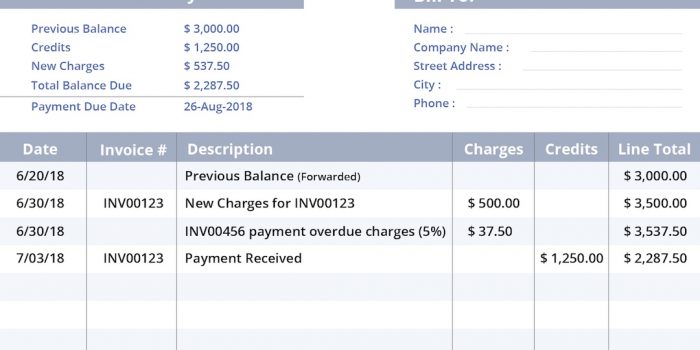

3. Bank statements

Lenders want to look at your bank statements as well as any other assets that you may own. This will help lenders know your spending habits and payment schedules.

4. Credit history

Think of your credit score as a report card for your spending. If you have a high credit score, you will get a higher loan amount with a lower interest rate than someone with a low credit score. If you have any delinquencies on your credit report, you can write a statement explaining the reason behind it. Lenders might look at this one-time unavoidable circumstance in another light.

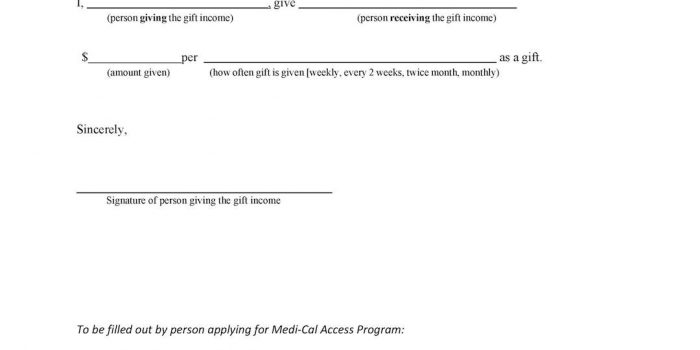

5. Gift letters

A gift letter can be written from your friends and family providing written documentation that the money you received was indeed a gift, not a loan and does not need to be repaid.

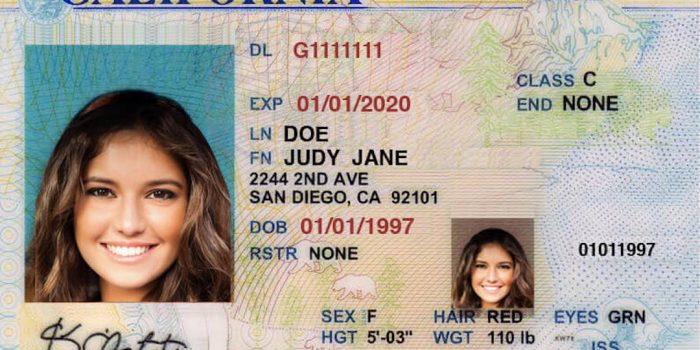

6. Photo ID

You will need to have your photo ID, such as your driver’s license or passport. This is merely to prove who you are claiming to be.

7. Renting History

For buyers who do not already own a home, lenders will ask for proof that you can pay on time. They could ask for a year’s worth of cancelled rent check or they could ask for your rent history. Your rent history is very important if you do not have an extensive credit history.