You likely already know that your credit score is what lenders use to determine whether you’ll be a responsible enough borrower to be approved for loans and credit cards. But there’s a good chance you have misconceptions about what will or won’t hurt your credit score.

Though, the three major credit bureaus use a complex way to get their calculations, the underlying idea behind them is fairly straightforward: if you have a history of paying your loan payments on time and in full, generally you’ll have a great credit score.

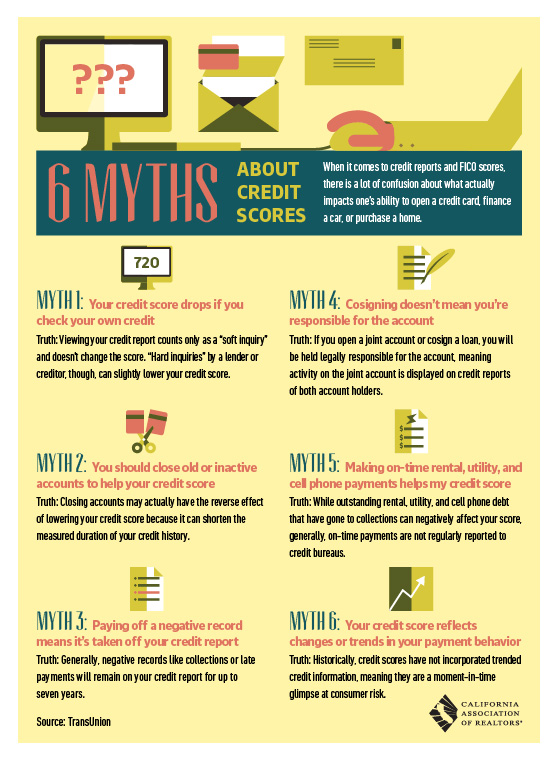

Credit scores may seem a confusing and complex. However, it pays to understand how they work so you can make informed decisions about your finances. These are six of the most common credit score myths to stop believing:

1) Your credit score drops if you check your own credit. Truth: Viewing your credit report counts only as a “soft inquiry” and doesn’t change the score. “Hard inquiries” by a lender or a creditor, though, can slightly lower your score.

2) You should close old or inactive accounts to help your score. Truth: Closing accounts may actually have the reverse effect of lowering your credit score because it can shorten the measured duration of your credit history.

3) Paying off a negative record means it’s taken off your credit report. Truth: Generally, negative records like collections or late payments will remain on your credit report for up to seven years.

4) Cosigning doesn’t mean you’re responsible for the account. Truth: If you open a joint account or cosign a loan, you will be held legally responsible for the account, meaning activity on the account is displayed for credit reports on both account holders.

5)Making on-time rental, utility and cell phone payments helps my credit score. Truth: , . While outstanding rental, utility and cell phone debt that have gone to collection can negatively affect your score, generally on-time payments are not regularly reported to the credit companies.

6) Your credit score reflects changes or trends in your payment behavior. Truth: Historically, credit scores have not incorporated trended credit information, meaning they are a moment–in-time glimpse at consumer risk.

By Torrey Felber, Marketing Director at Town Square Real Estate

[email protected]

858-829-5054